No secrets, justgood old-fashioned hard work.

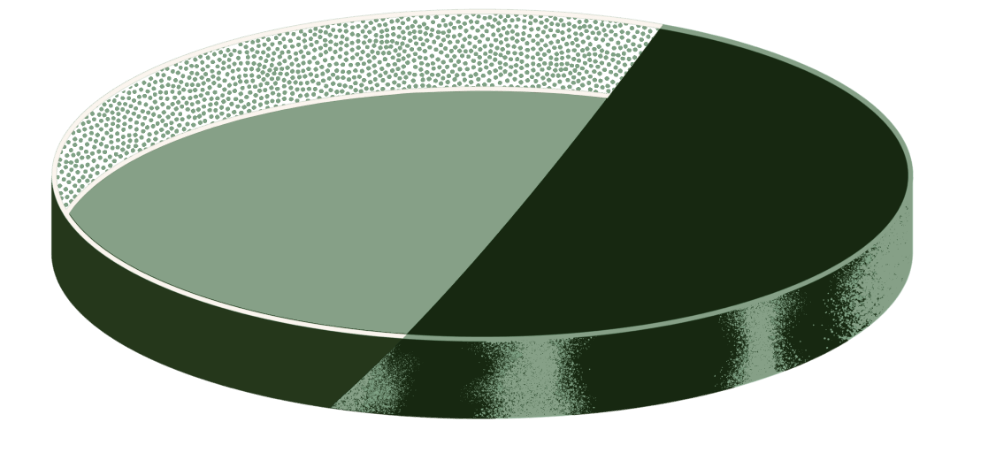

The secret to the stock market is there’s no secret to the stock market: even a dragon doesn’t have a crystal ball. However, you can ascertain what makes a business a profitable investment primarily through time-tested, rigorous fundamental analysis supplemented by technical principles.

Cognitive Approach:

01

Seek wise stewards of capital.

02

The best businesses operate in virtuous circles.

03

Ensure performance synergy between the investment and the firm.

04

Simplicity of the thesis’s argument.

The Pragmatic Approach:

For the love of the (treasure) hunt

We live for researching tremendous companies. Everything from how it was formed, the structure and story behind their management to how they treat their customers and employees. It’s why we love the investing world. We research for the love of the hunt, to fulfill our own insatiable curiosity, and so you don’t have to.

Sustained sprinting

We work diligently and tirelessly, yet patiently to optimize LP’s investment performance. We may be running a marathon, but rest assured, we are sprinting the entire way.

A single fund

We pride ourselves on being strong at what we are and transparent about what we’re not. We’re not built to be a “do-it-all, one-stop-shop." Our single mission is to grow and protect your capital.

Outsource fund administration

We outsource this part of the job to one of the top fund administrators in the world so we can maintain our focus on investing for you.

Assurance & Tax

We’re also using one of the top assurance and tax firms in the world so we can maintain our focus on investing for you. Rest assured in third-party validation.

No withdrawal waiting period

We hope that you will be around for at least 50 years but understand if your patience wears thin. Generating substantial compound interest is not for everyone.

Our Firm + Founder

From acting as a passive investor since before he could tie his shoes to founding the dragon of all hedge funds, meet Michael P Wahl, MD.

Continue